Divestment Policy: A Strategic Approach to Ethical and Sustainable Investing

A divestment policy outlines an organization’s commitment to withdrawing investments from companies or sectors that are deemed unethical, unsustainable, or misaligned with its values. Here’s an overview of what a divestment policy entails and how it drives positive change:

What is a Divestment Policy?

A divestment policy is a guideline directing an organization to sell off or avoid investments in specific industries, companies, or practices, often linked to social and environmental concerns.

Example: A university may adopt a divestment policy to avoid investing in fossil fuel companies, showing its commitment to sustainability and climate action.

Why Implement a Divestment Policy?

- Promote Ethical and Responsible Investment: Ensures investments align with values and avoids supporting harmful industries.

- Encourage Positive Change: Sends a message to companies to adopt sustainable practices.

- Mitigate Financial Risks: Reduces exposure to sectors facing decline or regulatory challenges.

- Enhance Reputation: Demonstrates a commitment to ethical and forward-thinking practices.

Key Areas for Divestment Policies

- Fossil Fuels: To combat climate change, many organizations avoid investments in oil, coal, and natural gas companies.

- Tobacco: Widely avoided due to public health concerns.

- Weapons and Defense: Some investors avoid companies involved in weapon manufacturing.

- Private Prisons: Avoided due to ethical concerns over profiting from incarceration.

- Human Rights Violations: Avoids companies complicit in forced labor or abuses.

Steps to Develop a Divestment Policy

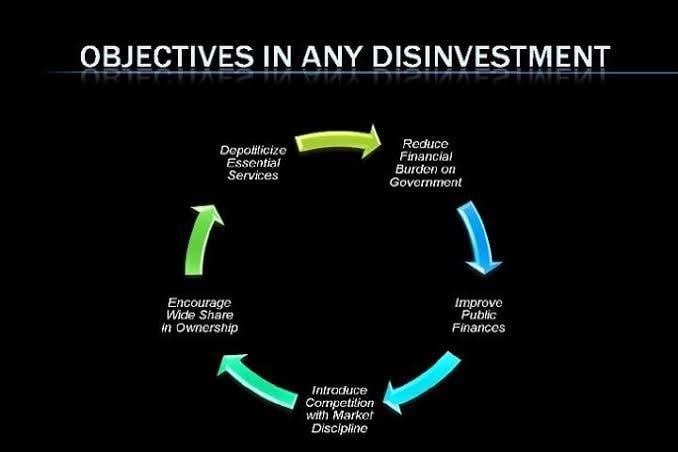

1. Define Objectives and Scope

Determine what the divestment policy aims to achieve and identify specific industries or practices to avoid. Align divestment goals with organizational values.

2. Conduct a Portfolio Assessment

Review current investments to assess where divestment is needed, identifying high-risk areas.

3. Set Clear Guidelines

Create criteria for selecting industries or companies for divestment based on factors like carbon footprint or ethical concerns.

4. Engage Stakeholders

Involve board members, investors, and employees to ensure alignment with priorities and gain buy-in.

5. Establish Timelines and Targets

Set realistic timelines for divestment actions and establish measurable targets.